Understanding An Amortization Schedule

By committing to a mortgage loan, the borrower is entering into a financial agreement with a lender to pay back the mortgage money, with interest, over a set period of time.

The borrower’s monthly mortgage payment may change over time depending on the type of loan program, however, we’re going to address the typical 30 year fixed Principal and Interest loan program for the sake of breaking down the individual payment components for this particular article about an amortization schedule.

On each payment that is made, a certain amount of interest is taken out to pay the lender back for the opportunity to borrow the money, and the remaining balance is applied to the principal balance.

It’s common to hear industry professionals and homeowners talk about a mortgage payment being front-loaded with interest, especially if they’re referencing an amortization chart to show the numbers.

While it may appear that there is more interest being paid at the beginning of a mortgage payment term, the truth is that the amount of interest decreases over time, while the money applied to the principal increases.

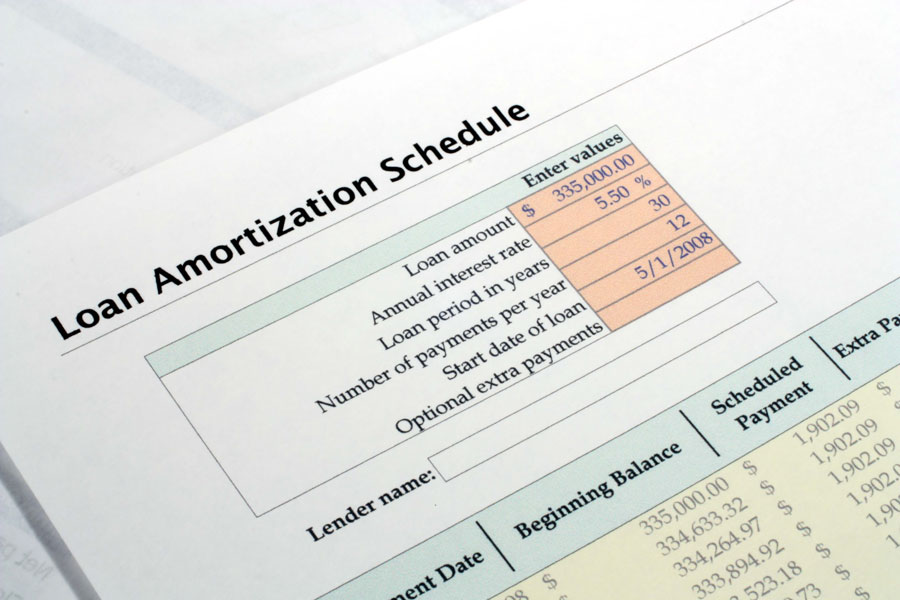

We can better understand mortgage payments by looking at a loan amortization chart, which shows the specific payments associated with a loan.

The details will include the interest and principal component of each periodic payment.

For example, let’s look at a scenario where you borrowed a $100,000 loan at 7.5% interest rate, fixed for 30 year term.

To ensure full repayment of principal by the end of the 30 years, your payment would need to be $699.21 per month.

In the first month, you owe $100,000, which means the interest would be calculated on the full loan amount.

To calculate this, we start with $100,000 and multiply it by 7.5% interest rate. This will give you $7,500 of annual interest.

However, we only need a monthly amount. So we divide by 12 months to find that the interest equals $625.

Now remember, you are paying $699.21. If you only owe interest of $625, then the remainder of the payment, $74.21, will go towards the principal. Thus, your new outstanding balance is now $99,925.79.

In month #2, you make the same payment of $699.21. However, this time, you now owe $99,925.79. Therefore, you will only pay interest on $99,925.79.

When running through the calculator in the same process detailed above, you will find that your interest component is $624.54. (It is decreasing!) The remaining $74.68 will be applied towards principal. (This amount is increasing!)

Each month, the same simple mathematic calculation will be made. Because the payments are remaining the same, each month the interest will continue to be reduced and the remainder going towards principal will continue to increase.

An amortization chart runs chronologically through your series of payments until you get to the final payment. The chart can also be a useful tool to determine interest paid to date, principal paid to date, or remaining principal.

Another frequent use of amortization charts is to determine how extra payments toward principal can affect and accelerate the month of final payment of the loan, as well as reduce your total interest payments.

_________________________________

Related Articles – Mortgage Payments:

- Mortgage Payment Basics

- Who Owns My Home If I Have A Mortgage?

- Why Do I Need Mortgage Insurance?

- Understanding An Amortization Schedule

- Shopping For A Hazard Insurance Policy

- Understanding the FHA Mortgage Insurance Premium (MIP)

- Do I Have To Continue Making My Mortgage Payment If My Lender Goes Bankrupt?