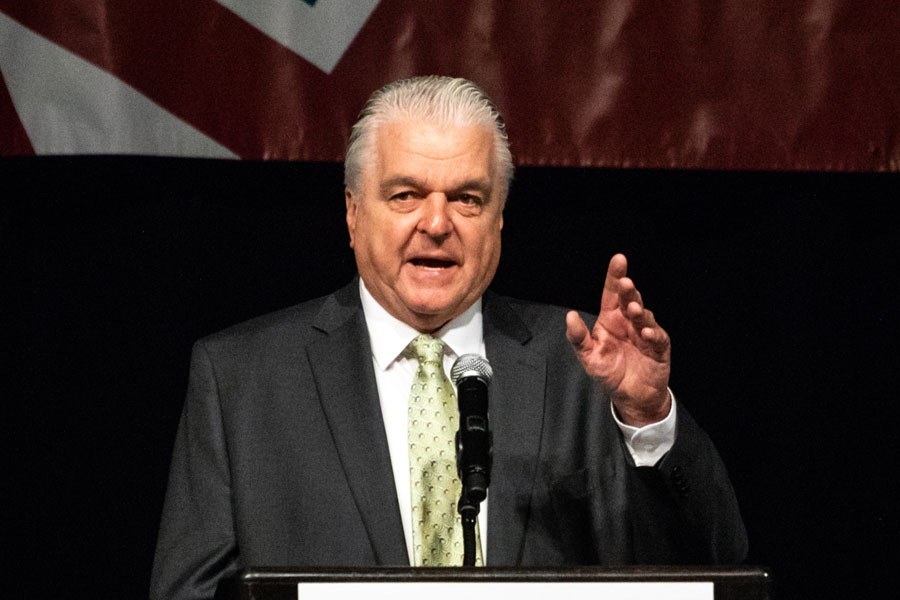

LAS VEGAS, NV – After offering a stay of execution that has lasted for months as it relates to those who have faced financial hardship due to the ongoing COVID-19 pandemic, Nevada Governor Steve Sisolak confirmed this week that the extended eviction moratorium he has authorized – which expired yesterday, Oct. 15 – will not be extended any further, giving numerous Las Vegas landlords and property managers free reign to begin eviction proceedings against thousands of tenants starting today.

The governor noted that, at this point in time, extending the eviction moratorium further “would just be duplicative.”

Sisolak had previously extended the eviction moratorium – which he originally enacted in March to assist the countless residents who were left unemployed and furloughed due to the pandemic – the day before it was due to expire on Sept. 1. However, Sisolak has also finally recognized the hardship his decree has laid upon Nevada landlords, who were expected to allow their tenants to remain in their homes while often receiving no rent at all, while being expected to maintain their normal level of services out-of-pocket.

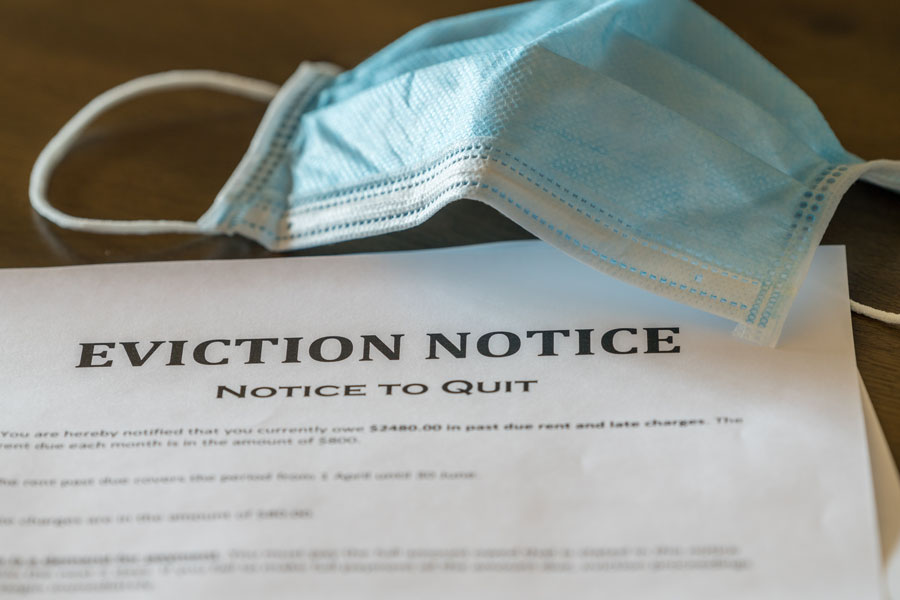

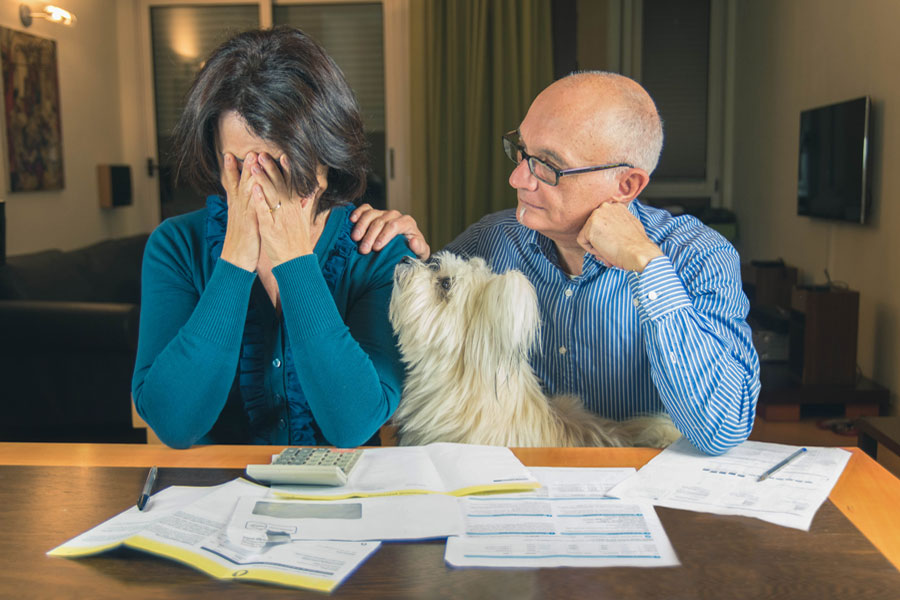

Tenants were not forgiven their missed rent as a result of the eviction moratorium, however, leaving many with a cumulative debt that they probably couldn’t hope to repay. State agencies encouraged tenants and landlords to negotiate settlement amounts, and ample government resources were made available to assist financially-strapped residents with making back rent payments, but this still didn’t address all of the issues being faced by Nevada residents throughout the pandemic.

President Donald Trump has also signed a federal eviction moratorium – enforced by the Centers for Disease Control and Prevention (CDC) that is in effect until Dec. 31. However, to take advantage of it, Nevada residents have to manually opt-in; it does not take effect automatically. Also, Landlords aren’t required to notify their tenant about the CDC order, but if renters believe they are eligible, they must sign a sworn affidavit and give it to their landlord or property manager to qualify.

Shelter Realty Property Management specializes in the areas of Henderson, Las Vegas and North Las Vegas, NV. Feel free to give us a call at 702.376.7379 so we can answer any questions you may have.

Christopher Boyle is an expert investigative journalist for SEARCHEN NETWORKS® and reports for independent news and media organizations in the United States. Christopher keeps a keen-eye on what’s happening in the Vegas real estate market on behalf of Shelter Realty Property Management