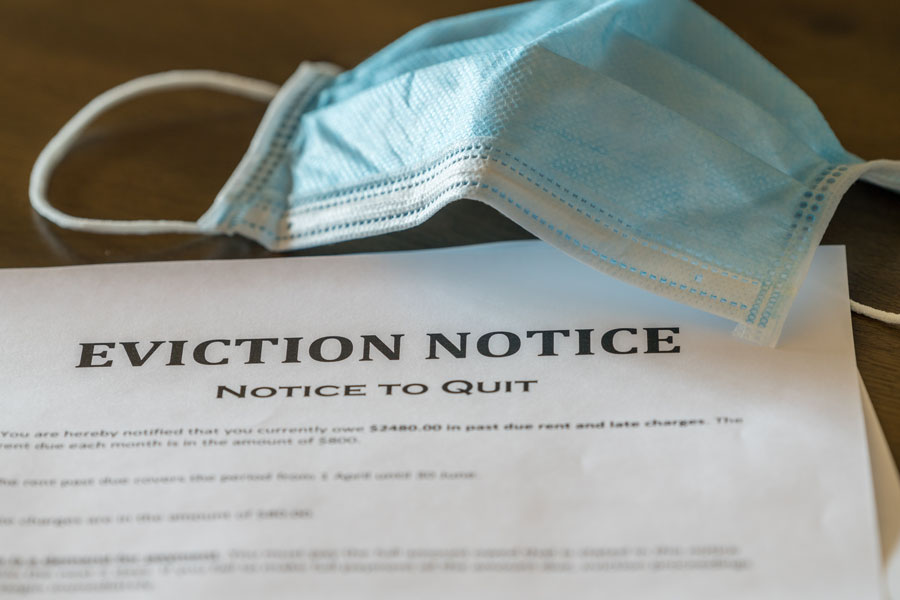

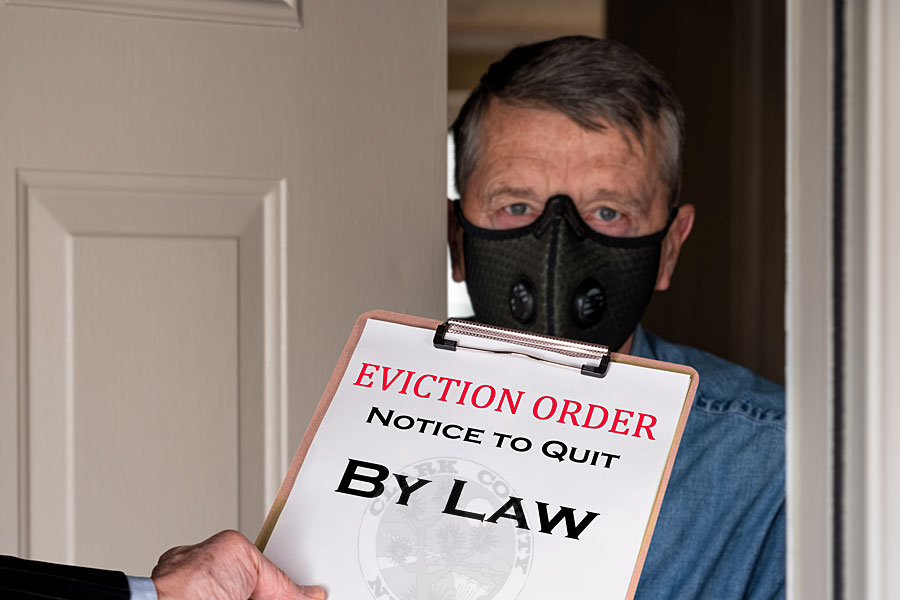

LAS VEGAS, NV – Nevada Governor Steve Sisolak’s residential COVID-19 eviction moratorium, originally set to expire on September 1 – but extended at the last minute for 45 days – is set to expire on October 15, Thursday of this week. Many expect the lift will result in a flood of eviction notices going out to tenants.

Sisolak initially instituted the moratorium due to the high degree of unemployment brought about by the onset of the COVID-19 pandemic – people were unable to be evicted for nonpayment of rent if it was due to issues related to the pandemic – but over time landlords were facing their own monetary hurdles in the form of tenants missing multiple rent payments; indeed a double-edged sword where both parties are hurting.

However, over time, the monies owed to landlords started to number in the thousands; indeed, when the moratorium expires this week – Sisolak has yet to comment on another extension, except to say that the moratorium “can’t go on forever” – countless eviction notices, already chambered for months, are due to be sent to tenants who may owe their landlords thousands of dollars in back rent, money that landlords may never see.

Still, it remains to be seen whether President Trump’s own recently-signed residential eviction moratorium, which authorized the Centers for Disease Control and Prevention (CDC) to prevent COVID-related residential evictions nationwide until December 31, will cause even more confusion.

Trump’s moratorium only applies if tenants actually opt into it. There are numerous requirements for the moratorium to take effect, including the applicant having exhausted all attempts to obtain any available government assistance, have an inability to pay rent due to financial distress which must be directly brought about by COVID-related circumstances, and other issues. Many of these situations require a tenant to sign a sworn affidavit in order for them to be protected.

Regardless of what happens this Thursday, there’s one thing for sure- people will be suffering on both sides of the equation. People out of work may very well end up on the street, and cash-strapped landlords will most likely end up having to give up thousands of dollars rightfully owed to them.

Shelter Realty Property Management specializes in the areas of Henderson, Las Vegas and North Las Vegas, NV. Feel free to give us a call at 702.376.7379 so we can answer any questions you may have.

Christopher Boyle is an expert investigative journalist for SEARCHEN NETWORKS® and reports for independent news and media organizations in the United States. Christopher keeps a keen-eye on what’s happening in the Vegas real estate market on behalf of Shelter Realty Property Management