LAS VEGAS – Famous Las Vegas landmark “A Little White Wedding Chapel” has been the site of many quick celebrity weddings, and according to reports it’s now going up for sale by owner Charlotte Richards, who has owned and run the establishment since it first opened its doors 68 years ago.

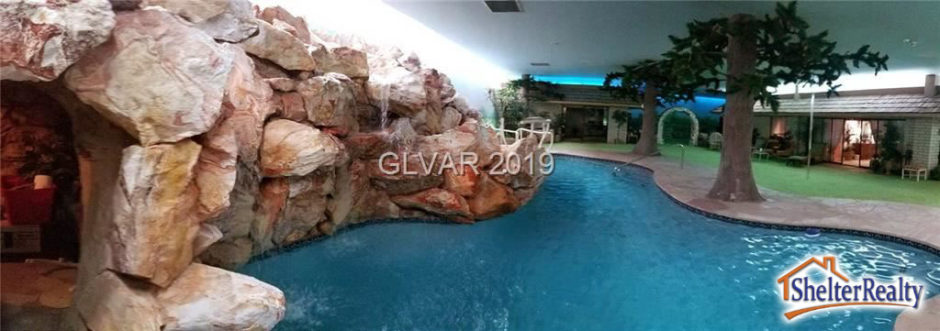

A Little White Wedding Chapel – which employs ten ministers and whose current asking price is $12 million – boasts of having joined over 1,000,000 couples in lawful matrimony; however, no statistics are available on how many of those couples have remained together. The Chapel is especially well-known for its “Drive-Thru Tunnel of Vows” wedding chapel, where eager couples can be married while on-the-go.

A Little White Wedding Chapel is located on South Las Vegas Boulevard, prime real estate with currently skyrocketing land values. The property is represented by Steve Khalilzadegan of Savi Realty, who noted in a press release that the 15,802 square-foot facility has over 222 feet of Las Vegas Boulevard frontage on a total of one full acre of property. The $12 million price tag for such a location, Khalilzadegan insists, is a steal for such an iconic Las Vegsa landmark.

A Little White Wedding Chapel is located on South Las Vegas Boulevard, prime real estate with currently skyrocketing land values. The property is represented by Steve Khalilzadegan of Savi Realty, who noted in a press release that the 15,802 square-foot facility has over 222 feet of Las Vegas Boulevard frontage on a total of one full acre of property. The $12 million price tag for such a location, Khalilzadegan insists, is a steal for such an iconic Las Vegsa landmark.

Richards came into the wedding business after her first husband abandoned her in Las Vegas, and Merle Edwards – who worked in the wedding chapel business – rescued her from the street and soon after became her second husband until his passing in 1982. Richards originally purchased the Chapel – at the time only consisting of a single room – in 1951, and soon expanded the facilities to include gown and tuxedo rentals, a florist, performing Elvis impersonators, and, of course, the infamous Drive-Thru Tunnel of Vows mentioned above.

During her time with A Little White Wedding Chapel, Richards has presided over the marriages of celebrities such as Frank Sinatra, Judy Garland, Rita Hayworth, Mickey Rooney, Michael Jordan, Britney Spears, James Caan, Patty Duke, Mary Tyler Moore, Paul Newman, Bruce Willis and Demi Moore. The Chapel has been featured on such TV shows as WWE Raw, Supernatural, Friends, Good Morning America, and The Real World: Las Vegas.

Shelter Realty Property Management specializes in the areas of Henderson, Las Vegas and North Las Vegas, NV. Feel free to give us a call at 702.376.7379 so we can answer any questions you may have.

Christopher Boyle is an expert investigative journalist for SEARCHEN NETWORKS® and reports for independent news and media organizations in the United States. Christopher keeps a keen-eye on what’s happening in the Vegas real estate market on behalf of Shelter Realty Property Management